AI Fraud Detection: stopping fraud before it happens

We can all agree that AI is becoming more and more important in our lives. From smartphones to smart homes, we see Artificial Intelligence is everywhere, making our day to day easier and more efficient. One of the most exciting areas is AI for fraud detection, where this technology is making a big difference.

Fraud is a huge problem that affects businesses and individuals alike. Whether it's fake ID documents, money falsification or identity theft, fraud can cause serious damage. Businesses lose billions of dollars each year to fraud, which also damages their reputation and trust with customers. Individuals suffer financial loss, stress, and the long, arduous process of restoring their identities and credit.

This is where AI comes in, offering a powerful tool to combat fraudulent activities. But how exactly can it help in this matter? Let's dive deeper into understanding this fascinating technology and its applications.

AI for Fraud Detection: how it works

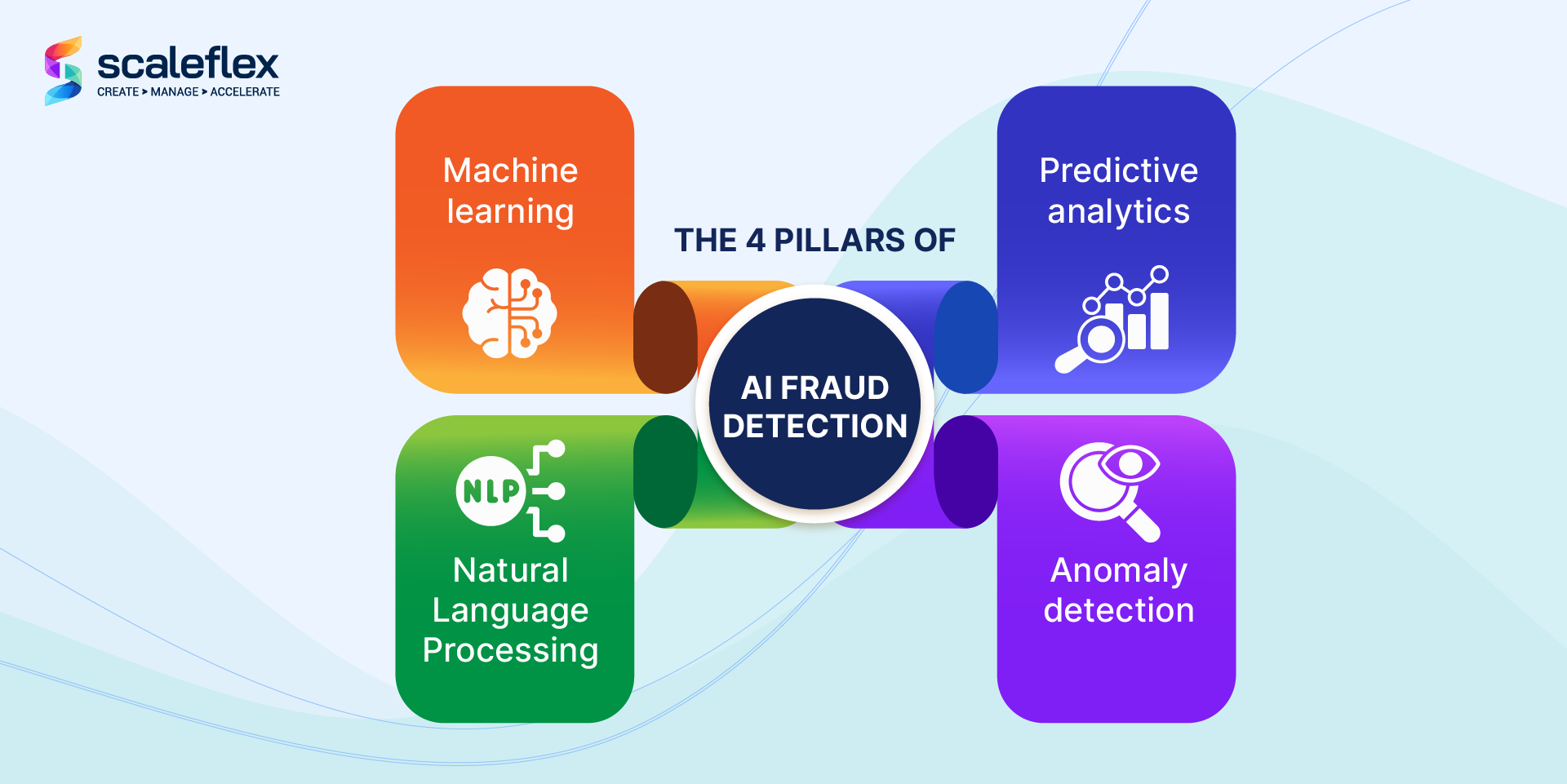

Advanced technologies are revolutionizing fraud detection with AI, as they provide the necessary tools to analyze vast amounts of data, recognize patterns, and make decisions in real-time. Here's how it works:

Machine Learning algorithms

Machine learning (ML) allows systems to learn from data and improve over time without explicit programming. In AI fraud detection, ML algorithms analyze transaction data, customer behavior, and other information to identify patterns and anomalies linked to fraudulent activities. For example, a sudden large international transaction in an otherwise local spending pattern can be flagged as suspicious.

Predictive analytics

Predictive models evaluate the likelihood of transactions being fraudulent based on factors like amount, location, and purchasing history. They do this by using historical data and algorithms to forecast future outcomes. This comes in handy for AI fraud detection, as it helps predict and prevent fraudulent activities by analyzing trends and patterns from past fraud cases.

Natural Language Processing (NLP)

Natural Language Processing (NLP) allows machines to understand human language, making it useful for analyzing unstructured data like emails and social media posts. In AI-powered fraud detection, NLP scans communications for signs of fraudulent intent, such as phishing attempts, by identifying suspicious language patterns or keywords.

Anomaly detection

Anomaly detection identifies outliers or unusual patterns in data that deviate from expected behavior. This method is effective for spotting fraud, as fraudulent activities often stand out from normal patterns. AI systems use statistical methods and neural networks to flag anomalies in real-time, such as an unusually high purchase in a short period.

AI systems continuously learn from new data and adjust their algorithms to stay ahead of emerging fraud tactics. This ensures fraud detection AI systems remain effective over time, adapting to new methods used by fraudsters and maintaining robust protection against threats.

But let's move on from how it does it and focus on the types of fraud it helps prevent.

Common Frauds Detected by AI

Let’s explore some of the most common frauds that AI helps to prevent, better understanding its critical role in maintaining security and trust across different sectors.

- Credit card fraud: AI detects unusual spending patterns, such as large or frequent transactions outside of a user's typical behavior.

- Identity theft: AI identifies discrepancies in personal information and unusual login patterns that may indicate identity theft.

- Insurance fraud: AI analyzes claims for inconsistencies and unusual patterns that suggest fraudulent activities.

- E-commerce fraud: AI flags suspicious activities like multiple failed transactions, unusual purchasing patterns, or fake reviews.

- Banking fraud: AI monitors transactions for signs of account takeover, unauthorized access, and money laundering.

AI encompasses a variety of technologies including machine learning, NLP (Natural Language Processing), and computer vision, a.k.a Visual AI. All of these are aimed at enabling machines to carry out complex tasks autonomously, and Visual AI is especially relevant when it comes to AI fraud detection.

How Visual AI works

We can think of this technology as a super-smart computer that can "see" and recognize things in pictures, just like a human can. Here’s a simple way to understand it:

- Image capture: Visual AI starts by capturing an image or video. This could be anything from a photo of an ID card to a surveillance video.

- Processing: using complex algorithms, the AI will then process the image and break down the image into tiny pieces to analyze each part.

- Pattern recognition: the AI will try to identify patterns or shapes in the picture, like specific facial features.

- Comparison: the AI will compare what it sees to a database of known images and will then make a decision based on that information.

Everyday Visual AI

Visual AI is used in many areas of our daily lives. Here are a few examples:

- Smartphones: When you use face recognition to unlock your phone, that’s Visual AI at work.

- Social Media: Platforms like Facebook use Visual AI to tag people in photos automatically.

- Healthcare: Visual AI helps doctors analyze medical images like X-rays or MRIs to detect diseases.

- Shopping: Online stores use Visual AI to recommend products based on the images of items you’ve viewed or bought before.

Key takeaways

As scammers become increasingly clever, the need for advanced detection technology becomes extremely important. AI provides a dynamic and powerful defense, outperforming fraudsters and protecting businesses and individuals from financial loss and reputational damage. By using AI, companies can protect their assets and maintain customer trust, ensuring a safer environment for all.

Fraud detection AI has completely changed the game by offering advanced tools that help us catch and prevent fraud like never before. Using these tools, we can quickly analyze huge amounts of data in real-time, meaning we are now capable of spotting unusual patterns and red flags that we would have normally missed, making fraud detection with AI not only more effective but also proactive.

AI-powered fraud detection is quite impressive, covering areas like banking, insurance, and online shopping. These AI systems keep learning and adapting to new tricks that fraudsters use, staying one step ahead. Plus, with Visual AI, which includes advanced image and video analysis, catching fraudsters becomes even more accurate.

Visual AI, apart from fraud detection, has other applications that can be useful to companies in industries like real estate, tourism and hospitality or even e-commerce. These applications go from NSFW image moderation, to background changer and removal or even auto-tagging. Find out more about Scaleflex Visual AI here!